Back

Back

With the rapid increase of renewable energy installed capacity in the world, ESS industry has shown a storage trend, and has gradually become an important support for energy transformation, and has increasingly attracted the attention of governments and enterprises. Energy storage system technology plays an important role in balancing supply and demand of the power system, improving the operation efficiency of the power system, and promoting the renewable energy, which is expected to bring unprecedented opportunities in the global energy industry. Under this background, in order to deeply research the trend of the global ESS industry in 2024 and explore the factors and impacts behind it, Dadong Times released the 《2024 Global ESS Industry Trend Forecast》 Report.

This report provides a comprehensive analysis for the global ESS market, and an overview of the market in each major country and an in-depth research on the opportunities for industrial and commercial ESS in 2024. At the same time, the report also summarizes the market trend in 2023, including the rise of industrial and commercial ESS industry, the introduction of global supportive policies, breakthroughs in centralized ESS technology, intensified market competition and high inventory pressure and other key factors. The report predicts that the global ESS industry will show the following characteristics in 2024:

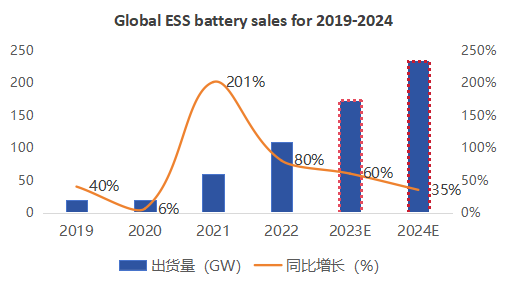

Market size: In 2024, global ESS battery sales will maintain a expansion trend and enter the stage with rational growth rate, which is expected to achieve a yoy growth rate of 35%, exceeding 200GWh. From the perspective of major markets, China contributed 46% of the installed capacity market, accounting for a significant increase; The ESS in the United States is affected by the delay of grid-connection project , and the overall proportion of incremental installation ranks second.

Data source:Dadong Times

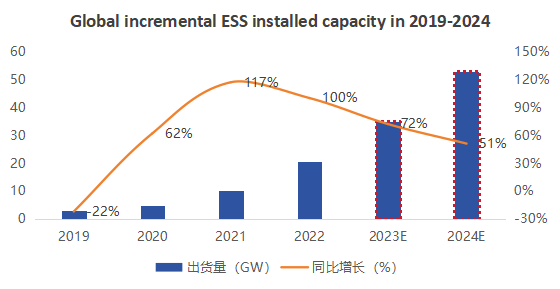

In addition, global ESS installed capacity in 2023 is 35GW, an increase of 72%, of which the lithium battery ESS project installed capacity reach 34GW. It is expected that the incremental installed capacity will exceed 50GW in 2024, and the growth rate will be more than 50%. Although new technologies such as vanadium flow batteries and compressed air energy storage are competing for development, lithium battery energy storage is still on absolutely dominant position.

Data source:Dadong Times

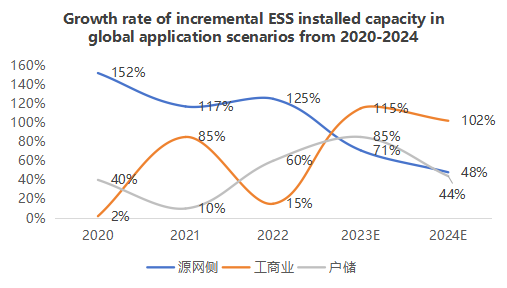

Application scenario: grid ESS will still occupy a dominant position, and industrial and commercial ESS will rise strongly. In 2022, the incremental installed capacity of ESS on the global grid increased by 124.69%, and is expected to reach 27GW in 2023, with a growth rate of more than 70%. China, the United States and Europe are the three major markets on the global grid ESS, with China surpassing the United States in 2022

Data source:Dadong Times

Price trend: Energy storage cell prices are expected to bottom out in Q2 2024. By the end of 2023, the price of energy storage cells has fallen by 50% compared with the beginning of the year, and the current industry average price is 0.4 yuan /Wh. It is expected to continue to decline to 0.3 yuan /Wh until 2024.

Product trend: It is expected that the cell will develop in the direction of 300+Ah cells, and the system will show the trend of 5MWh+ large energy storage system becoming the mainstream. In addition, in terms of large storage capacity, the prismatic cell length is thinner, and the large-capacity trend is obvious, such as BYD blade batteries. Large cylinder LFP batteries will accelerate to occupy the market share in the residential ESS market due to their significant advantages in performance, safety, cycle life, etc.

Technology trend: It is expected that the ESS technology will be lithium battery as the core, However, other technical routes such as sodium ion batteries, vanadium flow batteries, compressed air energy storage, etc., still have the development space.

In future, the global ESS industry will maintain the strong trend due to the opportunities brought by the energy transformation. China, the United States and Europe will be the three markets with the strongest growth momentum in the next five years. Among them, China and the United States are dominated by large-scale energy storage, and Europe will account for a relatively high proportion of household energy storage due to a series of factors such as a more decentralized power system and the Russia-Ukraine conflict.

Contents

2023 ESS industry review

1.Global ESS market

1.Global energy storage battery sales in 2019-2024

2.Proportion of application scenario in global energystorage batteries in 2023

3.China's energy storage battery sales in 2019-2024

4.Forecast of global incremental ESS installed capacity in 2019-2024

5.The proportion of major countries in the world's ESS capacity in 2023

6.Growth rate of incremental installed capacity in global application scenarios in 2020-2024

7.The proportion of Global ESS installed capacity in different application scenarios in 2023

8.Global energy storage battery inventory changes from 2020 - 2024

9.2023 European residential energy storage (battery) inventory changes

10.5MWh + energy storage system products since 2023

11.Progress of 300+Ah energy storage cells in major enterprises since 2023

12.6 major trends of ESS industry in 2024

2.Overview of ESS markets in major countries

1.2019-2024 China's incremental ESS installed capacity

2、The proportion of application scenarios in incremental installed capacity in China from 2020 - 2024

3. Scale of incremental ESS installed capacity in China's power generation part from 2019 - 2024

4. Scale of incremental ESS installed capacity in China's grid during 2019-2024

5. ESS installed capacity in the United States from 2019 - 2024

6. Proportion of application scenarios in ESS incremental installed capacity in the United States in 2023

7.2019-2024 growth rate of ESS installed capacity in various application scenarios in the United States

8.Incremental ESS installed capacity in Europe from 2019-2024

9.The proportion of ESS installed application scenarios in Europe in 2023

10.Growth rate of ESS installed capacity in various application scenarios in Europe from 2020-2024

11.2019-2024, Australia's ESS installed capacity

12.The proportion of ESS installed capacity in different application scenarios in Australia in 2023

13.ESS installed capacity in Japan's post-table market from 2019-2024

14.2018-2024 South Korea's incremental ESS installed capacity

3.Opportunities in Industrial and Commercial ESS in 2024

1.Incremental residential ESS installed capacity in China from 2019-2024

2.2023 China's industrial and commercial ESS installed capacity by region

3.Industrial and commercial ESS four business models

4.The average price spread between provinces and cities in 2023

5、2023 each provincial and municipal discharge electricity subsidy standard

6.2023 Capacity subsidy standard of each province and city

7.Comparison of different profit models in commerce and industry ESS in 2023

8.The proportion of application in China's industrial and commercial ESS project

9.Incremental industrial and commercial ESS installed capacity in the United States in 2019-2024

10.Comparison of industrial and commercial ESS subsidies before and after IRA bill release

11.Incremental industrial and commercial ESS installed capacity except for China and the United States market in 2019-2024

12. Opportunities in Southeast Asian industrial and commercial ESS market

The report can be obtained by contacting: luohuanta@dadongtime.com